Retrospective Appraisal: When and Why You May Need One

Historical Appraisal | Date of Death Appraisal

When most people think of a home appraisal, they imagine a report based on the property’s current market value. But there’s a lesser-known type of appraisal that plays a crucial role in legal, financial, and tax-related matters: the retrospective appraisal or also known as historical appraisal. This type of appraisal is focused on what a property was worth in the past, it looks back in time rather than at today’s market.

table of contents

What is a Retrospective Appraisal?

According to the Canadian Uniform Standards of Professional Appraisal Practice (CUSPAP), a Retrospective Value Opinion refers to “an Effective Date prior to the date of the Report.” In other words, a retrospective appraisal determines what a property was worth as of a specific date in the past.

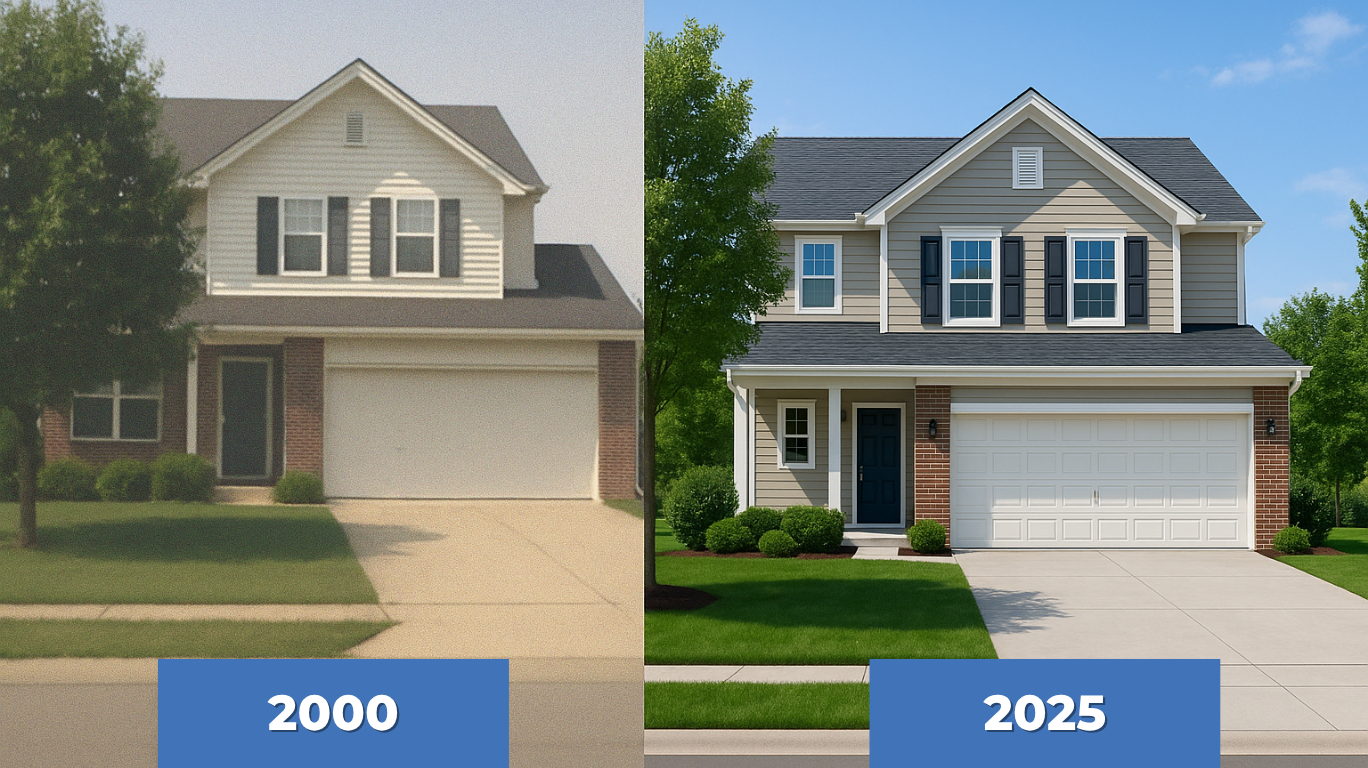

This type of appraisal is supported by historical data relevant to that specific point in time. Appraisers analyze past market conditions and trends, economic conditions and property improvements that were present on the selected date to provide a reliable and evidence-based valuation.

This type of appraisal is supported by historical data relevant to that specific point in time. Appraisers analyze past market conditions and trends, economic conditions and property improvements that were present on the selected date to provide a reliable and evidence-based valuation.

Sample Situation:

-

Sarah and Max, a couple from North Vancouver, bought their family home in 2015 for $680,000. They built a life together and raised two children, but in 2023 they decided to separate. In 2025, they are finalizing their divorce and planning to sell the house. A current appraisal shows the home is now worth $978,000. But under BC law, the value that matters for dividing family property is not what the house is worth today. It is what the home was worth when they separated in 2023.

To make sure the division of assets is fair, they request a retrospective appraisal based on the 2023 market. The report shows the home’s value at that time was $900,000. That $78,000 difference can have a big impact, especially if one of them wants to keep the home and buy out the other’s share. By using a historical valuation tied to the correct legal date, they are able to reach a more accurate and balanced agreement.

Why Do I Need a Retrospective Appraisal?

Here are some common situations where a retrospective appraisal may be needed:

1- Estate Settlement: When someone passes away, the value of their real estate as of the date of death is often needed to properly distribute the estate and calculate taxes. A retrospective appraisal ensures the property is valued accurately based on market conditions at that time.

2- Divorce: In the event of a marital breakdown, courts or lawyers may request a retrospective appraisal to determine the value of a shared property as of the date of separation. This helps ensure a fair and informed division of assets.

3- Capital Gains When selling an inherited or previously owned property, you may need to establish its market value on a past date to calculate capital gains tax accurately. A retrospective appraisal provides that historical value, which can have significant tax implications.

4- Tax Assessment Appeals

If you believe a past tax assessment was based on an incorrect property value, a retrospective appraisal can support your appeal by presenting a professional, third-party opinion of value for the specific assessment year.

Choosing the Right Appraiser for a Retrospective Appraisal

Retrospective appraisals require a careful analysis of historical market data and sound professional judgment to determine a property’s value as of a specific date in the past. These reports must meet the standards expected by courts, legal representatives, accountants, and government agencies.

When seeking a retrospective appraisal, it’s important to work with an appraiser who:

- Holds a recognized designation in your province or region

- Has experience with retrospective, legal, and financial-use appraisals

- Understands historical market trends in the property's area

- Can provide detailed written reports accepted by courts, accountants, and the CRA

Benefits of Retrospective Appraisals

Historical appraisals offer significant financial advantages across various situations, helping individuals and businesses secure favorable outcomes. By understanding the true value of an asset based on historical data, you can make more informed decisions that lead to substantial cost savings and better financial management. Here are some key benefits:

1- Optimized Tax Liabilities: A well-documented historical appraisal can assist in reducing tax burdens. In cases of tax assessment appeals, such as property tax disputes, proving the true historical value of an asset might lead to lower assessments, thus reducing annual tax obligations. This can translate into long-term savings for property owners.

2- Minimized Divorce Settlement Costs: During divorce proceedings, historical appraisals can play a pivotal role in determining a fair division of assets. By establishing the asset’s value at the time of acquisition or throughout the marriage, individuals can potentially avoid overvaluing assets, ensuring an equitable settlement without unnecessary financial strain.

3- Reduced Estate Settlement Expenses: In estate planning and settlement, a historical appraisal can help accurately assess the value of inherited assets, ensuring that heirs are not overburdened with taxes or other liabilities. It ensures that the distribution of assets is aligned with the intended value, avoiding conflicts and reducing the likelihood of costly legal disputes.

How Far Back Can a Property Be Appraised?

At WesTech, we can conduct retrospective appraisals as far back as the 1990s. While most retrospective appraisals are limited by the availability of reliable data, earlier dates present additional challenges. As data becomes more difficult to verify and is often stored in physical formats, accessing comparable information can be increasingly complex.

Summary

In summary, historical appraisals offer essential advantages in managing assets, reducing costs, and securing fair outcomes across different situations. From minimizing tax liabilities to facilitating smoother estate settlements, these appraisals provide clarity and financial peace of mind.

If you’re considering a historical appraisal, contact us today. Our team is here to provide expert insights and ensure you make well-informed decisions.

If you’re considering a historical appraisal, contact us today. Our team is here to provide expert insights and ensure you make well-informed decisions.

Beyond Property Valuation

WesTech’s Key Strengths:

Experienced company established in the local market for over 30 years

Brick and mortar local Vancouver Office where appraisers collaborate

Dedicated client care team offering excellent customer service and professional businesslike interactions whether by phone or email

100% of our appraisers are designated

Boutique firm focussed only in our local market serving Whistler to Chilliwack

Management still actively completing appraisals and are in tune with the market

Share:

Facebook

Twitter

LinkedIn

Email

WhatsApp